The US economy is one of the most diverse in the world and has a significant role in casinos. Casino industries are responsible for millions of jobs, and their relationship

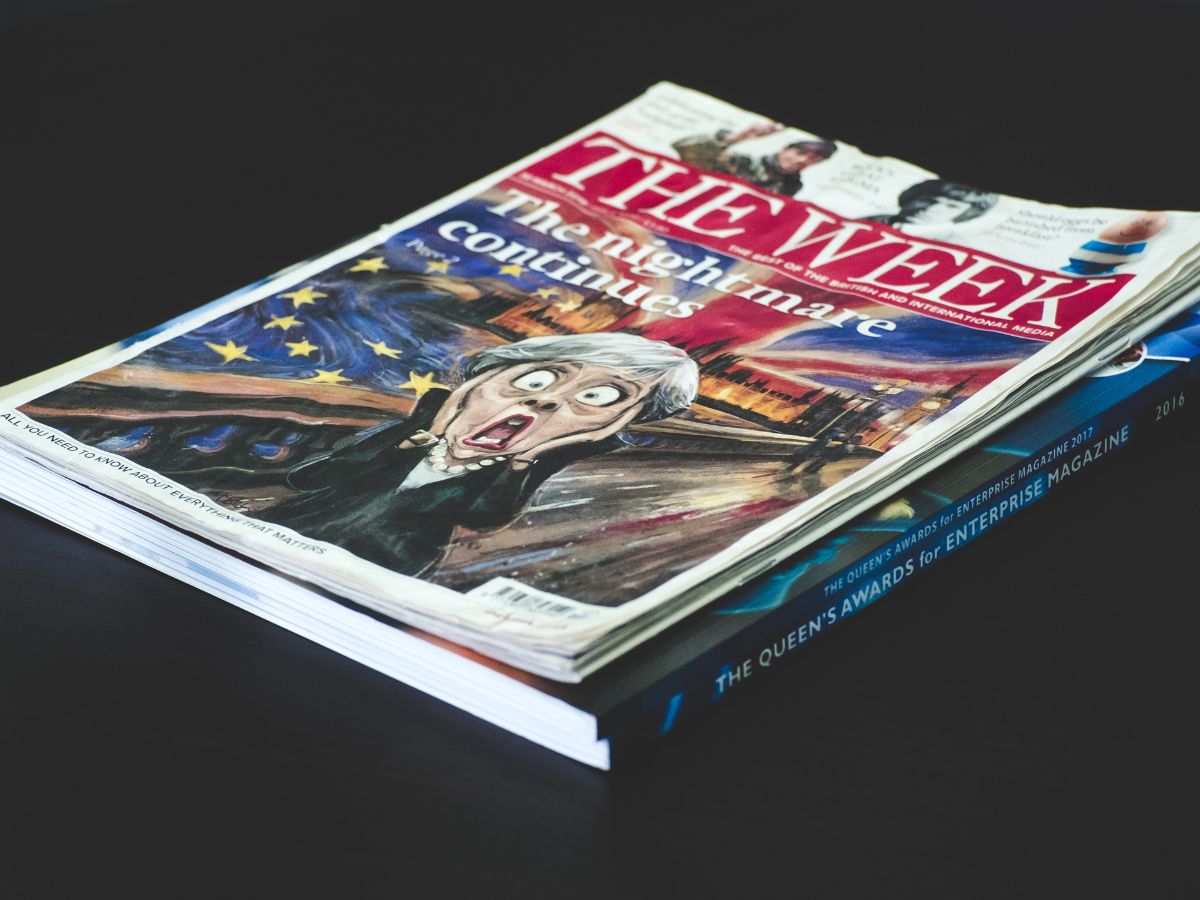

What is a satire news website?

Satire news is a type of news that uses humor and exaggeration to make a point. It can be used to comment on current events or to poke fun at

List of top satire news websites for slots

Satire news is a type of news that entertains and creates parody. Satire is a literary tool, used to criticize and make fun of individuals and society. Satires are designed

Get ready for the ultimate video slot experience with Trump It Deluxe.

Love him or hate him, you can’t deny that Donald J. Trump is a unique president. And now you can have a unique video slot experience with the Trump It

Casinos are Anticipating the US Elections

Casinos are anticipating the US elections, which could significantly impact the industry. They feel that it will be when customers want to support their businesses and that the industry will

5 Best Comic Slots You Must Play

Comic Book Slots are a new type of slot machine based on comic book characters. The game revolves around the history of comic books and their heroes, villains, and other

Play & Laugh: Comic book slots

Slots are among the most played Gambling games of all time. People enjoy trying their luck. They know that if their luck worked, they would be able to win lots